Contesting Finance

Aiming to build collective power in an age of financial absolutism, the Debt Collective is piloting a new kind of organization: the debtors’ union.

The Potential of Debtors’ Unions

- Issue #3

- Author

Financial markets are political. Stock markets, bond markets and derivatives markets do not merely (or even primarily) raise capital for goods and services. Rather, they all have direct and often harmful effects on people’s everyday lives. Our public universities issue bonds to cover the shortfall from tax cuts and, in turn, use ever-rising tuition dollars as collateral. Our mortgage, car and credit card payments are all securitized into short-term, lucrative investments for banks and investors, while for us they are shelter, food, and merely getting by. The municipal bond and sovereign debt markets have had plainly disastrous effects from Detroit to Puerto Rico to Greece — but for some they have been spectacularly profitable.

If financial markets are political, how can we contest them and their effects? What does civil disobedience and collective power look like in the age of finance? The Debt Collective is attempting to answer that question by piloting a new kind of organization: a debtors’ union.

You Say Finance, We Say Debt

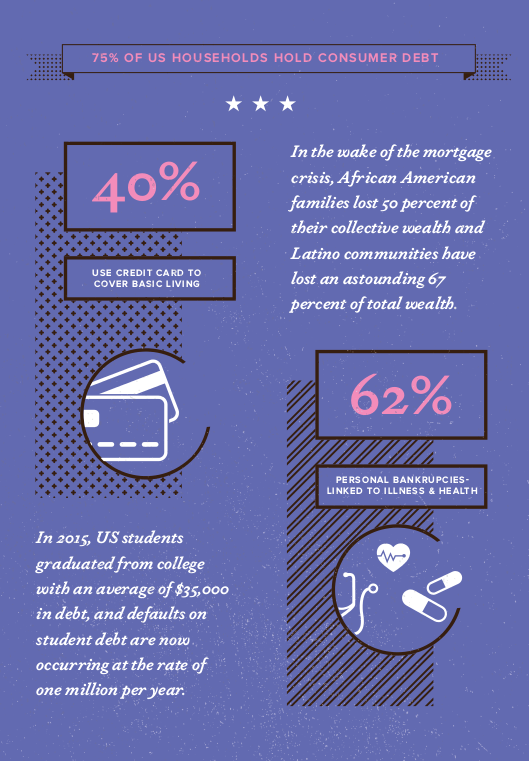

Today, 75 percent of US households hold consumer debt. All indications are that for most Americans, debt has become a basic fact of life — a circumstance necessary just to get by. Of indebted households, 40 percent use credit cards to cover basic living costs including rent, food and utilities. Some 62 percent of personal bankruptcies in the US are linked to illness and health care costs. In the wake of the mortgage crisis, African American families lost 50 percent of their collective wealth and Latino communities have lost an astounding 67 percent of total wealth.

In households that do not use formal banking services, 10 percent of families’ annual income goes to alternative financial services including revolving debts and exorbitant interest payments to check cashers and payday lenders. In 2015, US students graduated from college with an average of $35,000 in debt, and defaults on student debt are now occurring at the rate of one million per year. These experiences of mass indebtedness ramify through credit scores and reports, which ensure that people with lower scores pay higher interest rates, have a harder time finding places to live, and in many cases are even denied opportunities for work, thus reproducing cycles of debt and inequality.

In households that do not use formal banking services, 10 percent of families’ annual income goes to alternative financial services including revolving debts and exorbitant interest payments to check cashers and payday lenders. In 2015, US students graduated from college with an average of $35,000 in debt, and defaults on student debt are now occurring at the rate of one million per year. These experiences of mass indebtedness ramify through credit scores and reports, which ensure that people with lower scores pay higher interest rates, have a harder time finding places to live, and in many cases are even denied opportunities for work, thus reproducing cycles of debt and inequality.

Cities, states and entire countries have also been remade in the current debt-finance nexus. While both municipal and sovereign bonds have been in use for centuries (to fund infrastructure, public education and war, among other state endeavors), municipal debt alone has increased 800 percent over the past thirty years. As tax receipts have plummeted, cities turn increasingly to Wall Street for money, and they have been met with LIBOR fraud, toxic swaps and capital appreciation bonds with ballooning interest rates on the order of payday loans.

Massive bankruptcies in Jefferson County, Alabama and Detroit, Michigan, offer two recent examples of what happens when the finance industry decides where and how to invest municipal capital, always demanding a profit on “public” investment. And of course we all watched with baited breath as Greece took on its creditors in a protracted battle over control of a semi-sovereign state. The fight in Greece was only the most recent sovereign debt struggle in the era of finance, and was preceded of course by Argentina, Mexico, Indonesia, Mozambique, and most of the Global South in the era of structural adjustment.

Widespread municipal, state and sovereign austerity mean ever more virulent forms of individual indebtedness. According to a recently filed class-action lawsuit, the city of Ferguson, Missouri runs a modern debtors’ prison scheme in which impoverished people are routinely jailed because they are unable to pay debts incurred in the “criminal justice” system. The lawsuit details how Ferguson families take money needed for food, clothing, rent and utilities to pay ever-increasing court fines, fees, costs and surcharges. When they cannot pay, they are imprisoned.

Debt, Power and Exploitation

Needless to say, Ferguson is not alone. Across the United States, debt (along with outright state terror) often acts as a fearsome mechanism of racist social control—Jefferson County’s and Detroit’s bankruptcies must also be understood in this light. From Ferguson to Greece, debt is about power and subordination as much as it is about repayment at a profit.

It is no coincidence that these forms of indebtedness have risen exponentially along with the rise of Wall Street. Since business leaders re-discovered a more confrontational and unified class-based politics from above, they have managed to shrink wages and worker power while directing governments’ budgets away from the provision of public goods and the anti-poverty measures of the post-war period. Yet business profitability depends on consumer demand — indeed, global capitalism during the neoliberal era has relied in large part on the power of US consumers’ inclination to push their money back into the dollar-driven import-export cycle.

In the face of stagnant or declining wages, the obvious solution has been simply to lend consumers the money. More credit and debt means that an increasingly financialized business class actually gets paid (in the form of interest, fees and derivative profits) to provide the rest of us the money needed to keep demand inflated — until it pops!

In the face of stagnant or declining wages, the obvious solution has been simply to lend consumers the money. More credit and debt means that an increasingly financialized business class actually gets paid (in the form of interest, fees and derivative profits) to provide the rest of us the money needed to keep demand inflated — until it pops!

It is more profitable for the creditor class, in the short and medium term, to lend money at interest than to transfer it in wages. And as the government has offloaded the costs of public goods including medical care and education onto consumers, the demand for debt has only grown. In other words, credit has stepped in to “compensate” for falling wages, and debt thus becomes one of the central mechanisms of exploitation.

What does this mean for us? As financialized capitalism expands, so too do our debts: the financial sector has rapidly become the way we access many basic goods and services — food, shelter, medical care, education. In this terrain of mass indebtedness, disempowerment and debtors’ prisons, what does collective action look like? What does civil disobedience look like in the age of finance? What forms of material and conceptual subversion can we imagine?

Financial Disobedience

Debt fuels crises, taking power out of the hands of all but the financial capitalist class. Yet it also presents an opportunity for a new form of resistance to capitalist exploitation. The threat of crisis can be leverage for debtors. Experienced alone, debt is isolating, frightening and morally laden with shame and guilt. Indebtedness is being afraid to open the mail or pick up the phone. But as a platform for collective action, debt can be powerful. Consider oil tycoon JP Getty’s adage: “If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.” Student debt alone stands today at $1.3 trillion. Together, we can be the banks’ problem.

Let’s think back for a moment to the mortgage crisis, when non-payment of mortgage debts essentially took down the global economy. We can learn several things from this catastrophe. First, it is a great illustration of the centrality of debt payments to capital accumulation and stability today. Second, these mortgage debts could never have been repaid in the first place. In the financial frenzy of mortgage backed securities, reckless creditors interested only in short-term profit concocted wildly unsustainable lending schemes, selling borrowers mortgage packages they could never have paid off. The failure, in other words, was already baked in — the only question was: who would pay for it?

The bailout ensured that homeowners paid while banks, massive insurance companies and bondholders were made whole. And homeowners did not lose equally. Quantitative data in the American Sociological Review shows that the mortgage crisis represents one of the largest destructions of the wealth of people of color in US history. To be clear, it is not simply a matter of the crisis disproportionately impacting diverse populations. Rather, Black Americans have long been the target of economic violence, and 2008 was no exception. At the time, Wells Fargo loan officers devastated entire communities by pushing hundreds of Baltimore area homeowners (referred to as “mud people” by banking staff) with good credit into high-interest subprime mortgages they called “ghetto loans.”

The aftershocks of these practices are still being felt, in Baltimore and beyond. The results of the mortgage crisis were so devastating in part because, while banks and their lobbyists were well organized to fight for debt relief, the rest of us were not. (“They got bailed out. We got sold out.”) Imagine if the power of mortgage-holders — paradoxically, the power of their collective debt — had been deployed collectively and tactically to retain homes while forcing bondholders and creditors to sustain the losses. That is one potential of a debtors’ union.

Debt Resistance and Higher Education

Aiming to build collective power through debt organizing, but rigorously cautious about the pitfalls, we in the Debt Collective have been nosing our way towards a debtors’ union for a few years. Many of us first started plotting on the streets of Manhattan during Occupy. We educated ourselves about the nitty gritty of interlocking debt systems by collectively authoring a critical-analysis-cum-financial-literacy guide that we called the Debt Resister’s Operations Manual. We gained some unexpected mainstream media attention with our first initiative, the Rolling Jubilee, through which we have now bought and abolished nearly $32 million of medical and student loan debt on the secondary debt market for mere pennies on the dollar.

But these tactics were only preliminary — attempts to undermine two of the weapons in creditors’ arsenals: obscurantism and promissory moralism. When, via the Rolling Jubilee, we chanced upon a portfolio of private student debt from what was then one of the biggest chains of for-profit colleges in the country, Corinthian Colleges Inc., we knew we had found an opportunity to see if a confrontational form of debtor organizing could work.

Higher education offers both an exemplary case study of financialization and fertile ground for contesting that process. During the administration of Governor Reagan in California, states and the federal government began dramatically defunding both public and private universities. That process continued through the 2008 financial crisis and beyond. Early on, defunding was partly a right-wing attack on the institutions that nurtured 1960s radicalism. More recently, it has become a bipartisan class politics and a hallmark of neoliberalism.

While lamenting state cuts to higher education, college administrators have used the funding crisis to take on debt from Wall Street, frequently using tuition as collateral. This allows colleges to fund projects that have nothing to do with education, such as the construction of lavish stadiums and investments in real estate ventures. In league with Wall Street, the schools promise to pay off this debt by hiking tuition, forcing students further into the red.

In addition to turning ostensibly public universities into profit centers for the financial industry, student indebtedness has disastrous socio-cultural effects. Debt forces people to live lives focused on getting out of debt, rather than defining themselves or pursuing their curiosity and passion. Debt, again, becomes a successful disciplinary technique, eliminating life paths that don’t produce for capital. For-profit colleges take debt-financed higher education to its extreme. Their business model is to attract as many students disenfranchised by the mainstream educational system as possible, compelling them to mortgage their futures in return for subprime educations while funneling federal student loan money to executives and shareholders.

Getting Organized

For-profit schools are notorious for running afoul of the law. Corinthian Colleges Inc., once the nation’s largest for-profit educational chain, was no exception. The company has been accused of fraud and predatory lending by everyone from Attorneys General to the CFPB, gaming the federal student loan system to the tune of $1.4 billion in federal grant and loan dollars in 2010 alone, more than the ten University of California campuses combined for that same year.

As Corinthian’s many scandals grew increasingly public in the summer of 2014, a small group of former students had already begun to organize. Collaborating with these students, and enrolling technology experts and lawyers daring enough to take us seriously, we began to work closely with a group of 15 former Corinthian students who were ready to publicly declare their refusal to make any more payments on their federal student loans. To broaden the reach of this action to all current and former Corinthian students, including those who would choose not to join the strike, we also put together an online legal tool (via what was then a little-known provision in the Higher Education Act known as Defense to Repayment) that allowed students to challenge their debts with the Department of Education.

In February of 2015, after an intensive retreat with the strikers that included legal advice, story sharing and media training, the Corinthian 15 went public with their history-making strike. Requests to join the strike poured in from current and former Corinthian students across the country. Rather than merely mark down all of the thousands who wanted to join, we made sure that each potential striker understood the potential consequences of their act — a trashed credit score, wage garnishment, tax return garnishment, social security garnishment — phone call by phone call. Soon the strike had grown to 200 students, and their demand for debt cancellation had been endorsed by politicians and labor unions alike.

With the Corinthian 200 as our pilot union, we have begun to expand outward to other for-profit colleges working on the same model, including ITT Tech and Art Institutes. Organizing debtors is complex, and the barriers to organizing debtors’ unions are high. There are no shared factory floors. People in debt to the same institution are often geographically remote and disconnected from one another. Many debtors don’t know who profits when they pay their debts, or who stands to lose if they don’t. Debtors struggle to distinguish originators, aggregators, guarantors and servicers. For instance, most student debtors think they have Sallie Mae loans because Sallie Mae is their servicer. But many are actually in debt to Citibank, Chase, Deutsche or the Department of Education. And of course, once our student loans are pooled and tranched into asset-backed securities, their owners are dispersed further still.

To build collective power in these conditions, we know that we must work towards understanding Wall Street’s role in mass indebtedness. That is to say that we must politicize the bond market. As public institutions like the University of California effectively take orders from Moody’s bond rating agency, we must ask: what is the effect on secondary markets of the Federal guarantee of student loans? Who is profiting from student loans? Who is profiting from unsustainable mortgage markets? Who is profiting from municipal debt that wreaks havoc on our communities? When we can leverage the credible threat of collective, targeted non-payment over banks, when we can force the bond market to take losses, then we will have realized the power of debtors’ unions.

As the Corinthian debt strikers continue to press their demands, we know that re-envisioning higher education is only the beginning of what debtors’ unions can do. Imagine the power of mortgage-debtors’ unions to leverage eminent domain to halt foreclosures, or criminal justice debtors-unions gumming up the works of the debt-to-prison pipeline from Ferguson to Los Angeles. Debtors’ unions can change the spaces of possibility across the unequal landscapes of contemporary capitalism. But only on-the-ground organizing, with all its challenges and imperfections, can make such action possible. Most of this work has never been done before, so a willingness to experiment is in order.

Experimentation with Debt

We see this sort of experimentation with debt as complementary to other forms of collective resistance. Debt, after all, is a claim on future wages. As Fight for $15 movements triumph across the country there is little solace to be had if the cost of housing and education continues to skyrocket. A substantial portion of union wages go towards repaying consumer debts, to say nothing of the relationship between massive union pension funds and their role in the financial system. In other words, debt, wages and benefits are intertwined under financialized capitalism, and need to be addressed together.

In a way we find exciting, debt organizing and labor organizing have different targets, and thus different (and again, complementary) potential outcomes. Labor organizing targets the employer, workplace regulation and the means of distributing corporate surplus. The workplace’s economic role in a worker’s life is the payment of wages and benefits, so labor organizing naturally focuses on how we (don’t) get paid. Debt organizing, on the other hand, targets the creditor, the regulation of lending and the means of financing the good or service in question. Thus, debt organizing naturally focuses on how and by whom things we care about (education, healthcare, housing) are paid for. This means that debtors’ unions are not simply renegotiating debt but also forcing open questions that the era of finance seems to have foreclosed: how do we even pay for things in the first place?

The challenge is to build a politicized class of debtors who go beyond particular victories toward collective power writ large. One outcome of successful organizing could, of course, be a debt jubilee — perhaps better called a “fast bailout” in which bondholders take deep losses and the slate is wiped relatively clean. But we cannot stop there. A major debt jubilee would be a significant victory, but only if it was coupled with a deep, durable shift in the distribution of political and economic power.

With this shift, both creditors and debtors would negotiate the terms of every contract, and indeed, produce a world in which indebtedness is no longer required to finance life’s most basic needs. Were a jubilee to occur as a “benevolent gift” from creditors to debtors, without an accompanying power shift, crises of indebtedness would continue indefinitely because debtors would remain without a seat at the bargaining table. Moreover, if a jubilee were to occur without a substantive reimagining of our economic system, and a collective reckoning with the way debt is and has been used as a mechanism of social control, we will have gained little.

What this new economic system might look like — the ways it would use socially productive forms of debt and credit, the ways it might enable a truly democratic society — remain to be seen. What we know is that debtors’ unions could give us a timely tactic through which to build collective power — and it is only through collective power that we will be able to answer these questions for the first time.

Source URL — https://roarmag.org/magazine/debt-collective-debtors-unions-resistance/

Next Magazine article

Defeating the Global Bankocracy

- Jerome Roos

- September 21, 2016

The “Golden Noose” of Global Finance

- Fanny Malinen

- September 21, 2016